Paycheck tax calculator georgia

Paycheck Results is your gross pay and specific. Georgia Income Tax Calculator 2021 If you make 70000 a year living in the region of Georgia USA you will be taxed 11993.

Georgia Sales Reverse Sales Tax Calculator Dremploye

If youre age 62 to 64 this.

. Georgia Hourly Paycheck Calculator Results. Find The Best Payroll Software To More Effectively Manage Process Employee Payments. Ad Looking for ga payroll calculator.

Ad Compare Prices Find the Best Rates for Payroll Services. This includes tax withheld from. Georgia Paycheck Calculator Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Georgia. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Georgia.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. Withholding tax is the amount held from an employees wages and paid directly to the state by the employer. Below are your Georgia salary paycheck results.

To use our Georgia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Get Your Quote Today with SurePayroll. The Federal or IRS Taxes Are Listed.

All Services Backed by Tax Guarantee. Content updated daily for ga payroll calculator. Just enter the wages tax withholdings and.

The state income tax rate in Georgia is progressive and ranges from 1 to 575 while federal income tax rates range from 10 to 37 depending on your income. The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Georgia State. After a few seconds you will be provided with a full breakdown.

Wages Nonresident distributions Lottery winnings. Make Your Payroll Effortless and Focus on What really Matters. The Georgia bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Simply enter their federal and state W-4 information as. Your average tax rate is 1198 and your marginal tax rate is. Luckily our Georgia payroll calculator eliminates all the extra clutter associated with calculating payroll so your administrative duties wont be quite as dull.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate Tax. Tax Calculators Tools Tax Calculators Tools.

Well do the math for youall you need to do is enter. Yes as Georgia does not tax Social Security and provides a deduction of 65000 per person on all types of retirement income for anyone age 65 and older. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Georgia Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. This calculator can estimate the tax due when you buy a vehicle. All you have to do.

Get Started Today with 1 Month Free. The Georgia Tax Calculator Lets You Calculate Your State Taxes For the Tax Year. The results are broken up into three sections.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Georgia.

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Copy Of Copy Of Calculate What Affects How Much We Pay In Taxes Hbsmba 1935 2 Harvard Studocu

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Payroll Taxes For Your Small Business

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

![]()

Georgia Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Paycheck Calculator Take Home Pay Calculator

Use Smartasset S Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs Retirement Calculator Financial Advisors Tax

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

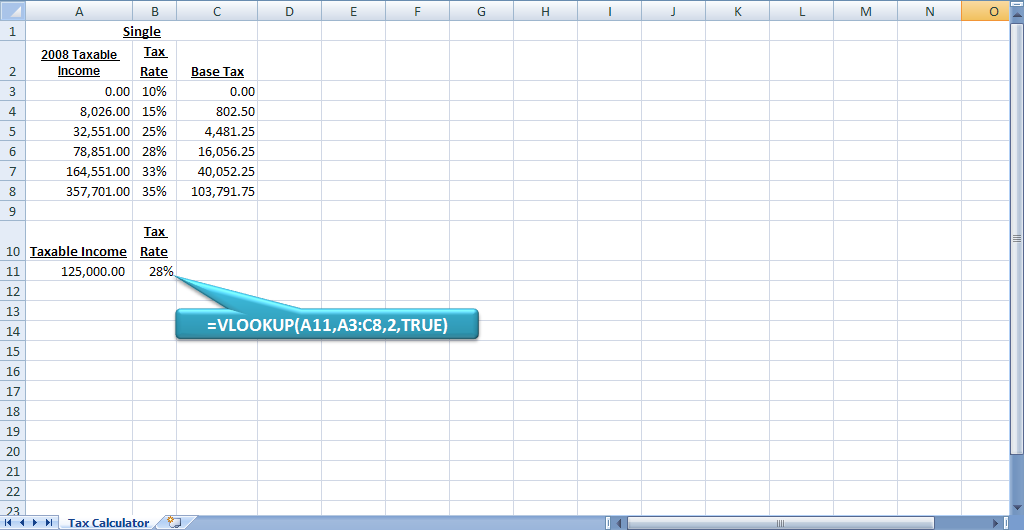

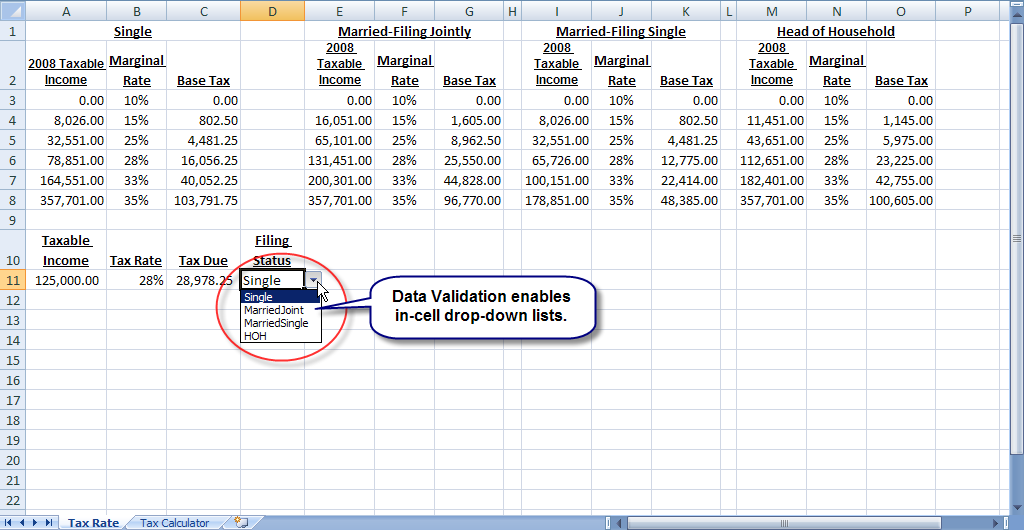

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Georgia Paycheck Calculator Smartasset

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator Take Home Pay Calculator

Income Tax Calculator Estimate Your Refund In Seconds For Free

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc